Q2 was a period of rising house prices and demand for homes — a common trend we saw across many housing markets in the United States — but things slowed down in Q3 as we approached the final stretch of the year. Although the housing market usually slows down near the end of the year in preparation for the holidays, other factors, such as inflation and rising interest rates, are weighing on the minds of Cobb County residents.

As The Federal Reserve continues to hike interest rates in response to inflation that quickly grew out of control over the past year in the wake of the pandemic, sellers are having to adjust home prices in response to buyers who are growing increasingly wary of rising mortgage rates. While it remains to be seen whether The Fed will continue to raise rates into next year, economists anticipate that mortgage rates will likely continue to rise depending on the state of the economy and whether inflation is still out of control.

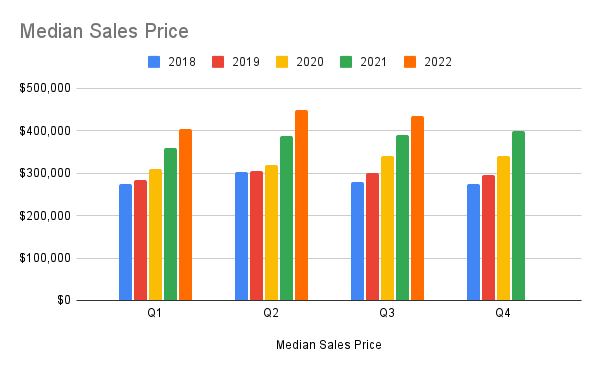

Median Sales Price in Cobb County

As buyers grew cautious with The Fed’s ongoing interest rate hikes, demand for homes dipped slightly in Q3 of 2022. Cobb County saw the median sales price for homes hovering at $435,000 in Q3, down from $450,000 in Q2—a decrease of 3.3 percent. Although this is a small decrease, it does represent a shift in the market. That said, the median sold price remains higher than Q3 of 2021—which was $390,000—making Q3 of this year an 11.5 percent increase over the same time last year.

This data suggests that the housing market may be beginning to slow down as demand adjusts. The small decline in median sales price is due to rising inflation and interest rates, pricing some low-end buyers out of the market. While this does mean that sellers will need to be smart about pricing their homes to remain competitive, the good news is that there will always be buyers for homes—no matter the state of the market. There are always circumstances that necessitate a move.

Number of Homes Sold

Accompanying the decrease in median sales price for homes across Cobb County, the overall volume of homes sold went down in Q3. This is because–due to rising interest rates–fewer buyers were in the market to purchase. Q2 saw 2,665 homes sold, but that number has since dropped to 2,213 in Q3—a decrease of 17 percent. Furthermore, it is an even steeper decline from the volume of homes sold in Q3 of 2021, which saw 3,055 homes sold—a drop of 27.6 percent.

This indicates that the market is shifting away from favoring sellers and is balancing out as inventory continues to grow in light of the declining demand. While Cobb County remains a sellers market–as it has for much of the last decade–it is uncertain how much longer the sellers market will continue. Interest rate hikes and inflation could drive mortgage rates upward, leading to fewer sales and further decreasing demand for homes.

Median Days on Market

As is expected with lower demand, homes spent more days on the market in Q3. In Q2, the median number of days on market for homes was five days. By contrast, Q3 saw that number rise to nine days. Compared to Q3 of 2021—when houses spent a median six days on market—we are looking at a 50 percent increase in the number of days. Experts predict that this trend could continue for the time being, further increasing the days on market.

The biggest draw here is that the housing market is beginning to balance out and no longer heavily favors sellers. The decrease in demand will continue to build inventory until it eventually reaches an equilibrium—with six months of inventory considered a balanced market. Inventory is not that high yet in Cobb County, but it could continue to rise – should the market’s trajectory continue as it is and The Fed keeps raising interest rates.

Mortgage Rates in Cobb County

Although housing prices appear to be stabilizing in housing markets across the nation, mortgage rates will likely go up in the foreseeable future. Rapid inflation will continue to drive the government’s economic policy, and The Federal Reserve may introduce another hike in base interest rates to curb inflation. In September, the Federal Reserve increased interest rates again by another 75 basis points (0.75%) with the target of raising base interest rates to between 3 and 3.25 percent – resulting in mortgage rates rising across the country.

In Cobb County, this has led to 30-year fixed mortgage rates reaching 6.51 percent and 15-year mortgage rates hitting 5.66 percent as of the time of writing. For now, experts anticipate inflation to continue to pose a challenge for housing markets across the nation and for buyers and sellers. There is a high chance that The Federal Reserve will continue to raise interest rates throughout the rest of the year and likely into 2023. Some economists even suggest that the base interest rate could reach as high as 4.6 percent by 2024, should The Fed’s current efforts fall short and inflation continues to spiral out of control.

Future Market Predictions

As inventory continues to grow alongside the decrease in demand for homes across Cobb County, rising inflation and higher interest rates will continue to be an influence on the market—one that will weigh heavily on the minds of buyers and sellers alike.

Buyers should keep monitoring The Fed’s economic policy and interest rates and lock in a good deal when they spot one. Meanwhile, sellers that wish to sell soon must adjust to market demands and price their homes appropriately to attract buyers.

In either case, buyers and sellers should keep a close eye on the state of the market and speak with their agent to determine the best time to buy or sell.